Simply Finance 101: How To Set Up A Sinking Fund

We wanna educate you and answer your F-A-Qs about Sinking Funds. Are you getting anxious over the inevitable purchases or big expenses you’ll be making this year? Ease your financial stress and create a sinking fund that will simplify your overwhelming financial goals.

A sinking fund is a type of fund set up to strategically save money to achieve your financial goals. With a sinking fund, you set aside a certain amount of money from your income every month for a specific goal. This is a smart way to work towards your goals, cultivate good saving habits, and boost your financial confidence.

You can create sinking funds for a lot of different goals. Typically people create a sinking fund for the upkeep of their house or their car. People also make use of sinking funds to deal with debt but you don’t have to limit yourself to that. It’s all up to you and the specific goals and milestones you want to manifest in your life. You can even make one for an upcoming island getaway with your barkada or for a gadget upgrade you’ve been eyeing.

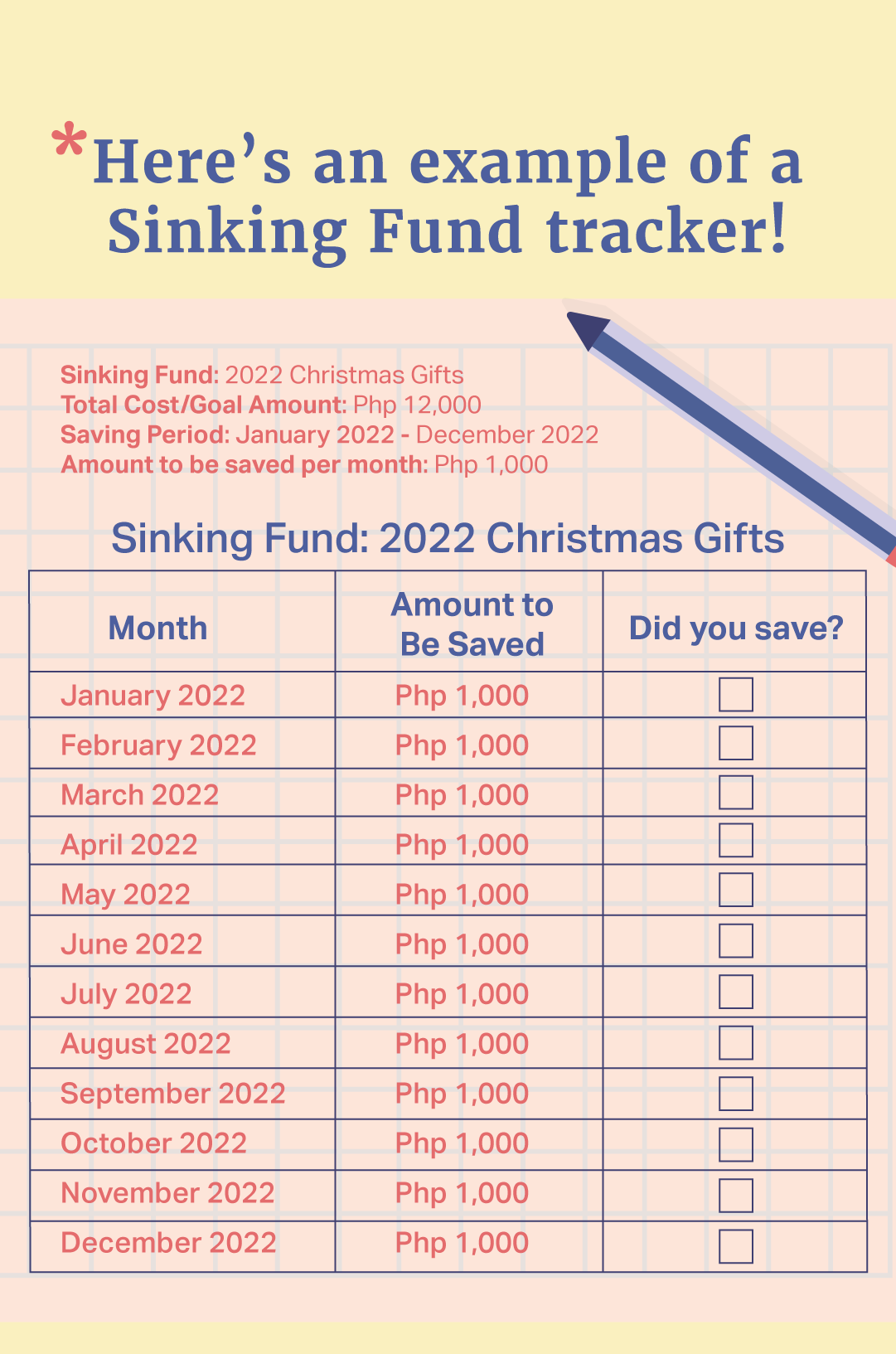

Set your goal. What do you wanna save up for?

Determine how much you need to save to achieve your specific goal

Establish the saving period or how long you’ll be saving for this specific goal. This will help you determine how much you need to save every month!

Decide where you’ll be saving your sinking fund

Create a Sinking Fund tracker so you can stay on top of your goals every month

It’s best to keep your sinking fund saved in a high-yield savings account so you can simultaneously earn interest periodically. Especially if you have a long-term sinking fund like a wedding sinking fund that could take up to 3 to 5 years to complete.

Here’s a list of high-yielding savings accounts in the Philippines:

Tonik Bank Stash - Interest rate: 4% (Solo Stash) / 4.50% (Group Stash)

DiskarTech - Interest rate: Up to 3.25%

CIMB GSave - Interest rate: Up to 2.6%

CIMB Bank UpSave - Interest rate: Up to 2.5%

Komo - Interest rate: Up to 2.5%

ING Save - Interest rate: Up to 2.5%

The simple answer is: An emergency fund “saves you” from emergencies and unprecedented expenses while a sinking fund “prepares you” for specific goals or expenses that you can anticipate.

The bottom line is it is important to have both, an Emergency Fund and a Sinking Fund, to avoid financial anxiety and to fortify your financial security.

If you have any more questions about sinking funds, feel free to comment down below! When in doubt you can always book a free discovery call with Simply Finance so we can help you set up sustainable financial systems with a Financial Plan or find Simple Solutions for your financial struggles.